Everything You Need To Know About The Automatic Stay

The automatic stay is bankruptcy’s most immediate protection, taking effect the moment a petition is filed. This court-issued injunction prohibits most creditor collection activity for the duration of the case—but its scope has specific boundaries. Understanding what the stay halts, which obligations remain enforceable, and when creditors can petition for relief is essential for anyone evaluating bankruptcy as a financial solution.

Upon filing, the stay immediately halts collection calls, lawsuits, wage garnishments, repossessions, and foreclosures. Creditors cannot continue enforcement actions that would impair the estate during the bankruptcy process. This suspension allows the debtor and trustee to assess assets, prioritize obligations, and develop a reorganization or liquidation strategy.

The stay’s scope is broad: it enjoins unsecured creditors from judgments and collection suits, halts secured creditors’ repossession and foreclosure proceedings, and pauses IRS tax levies and liens—with narrow exceptions for support obligations and certain tax assessments. The stay does not eliminate debt; it suspends collection enforcement, giving bankruptcy priority over individual creditor recovery. Violations expose creditors to sanctions and damages.

The stay does not enjoin all creditor actions. Criminal prosecutions proceed unimpeded. Support obligations—child support and alimony—remain enforceable because federal law prioritizes family support. Tax authorities may continue certain administrative proceedings and audits, though collection is paused. Landlords holding final judgments for possession may continue eviction. In cases of repeat filings within one year, the stay’s duration is substantially curtailed unless the debtor demonstrates extraordinary circumstances justifying extension.

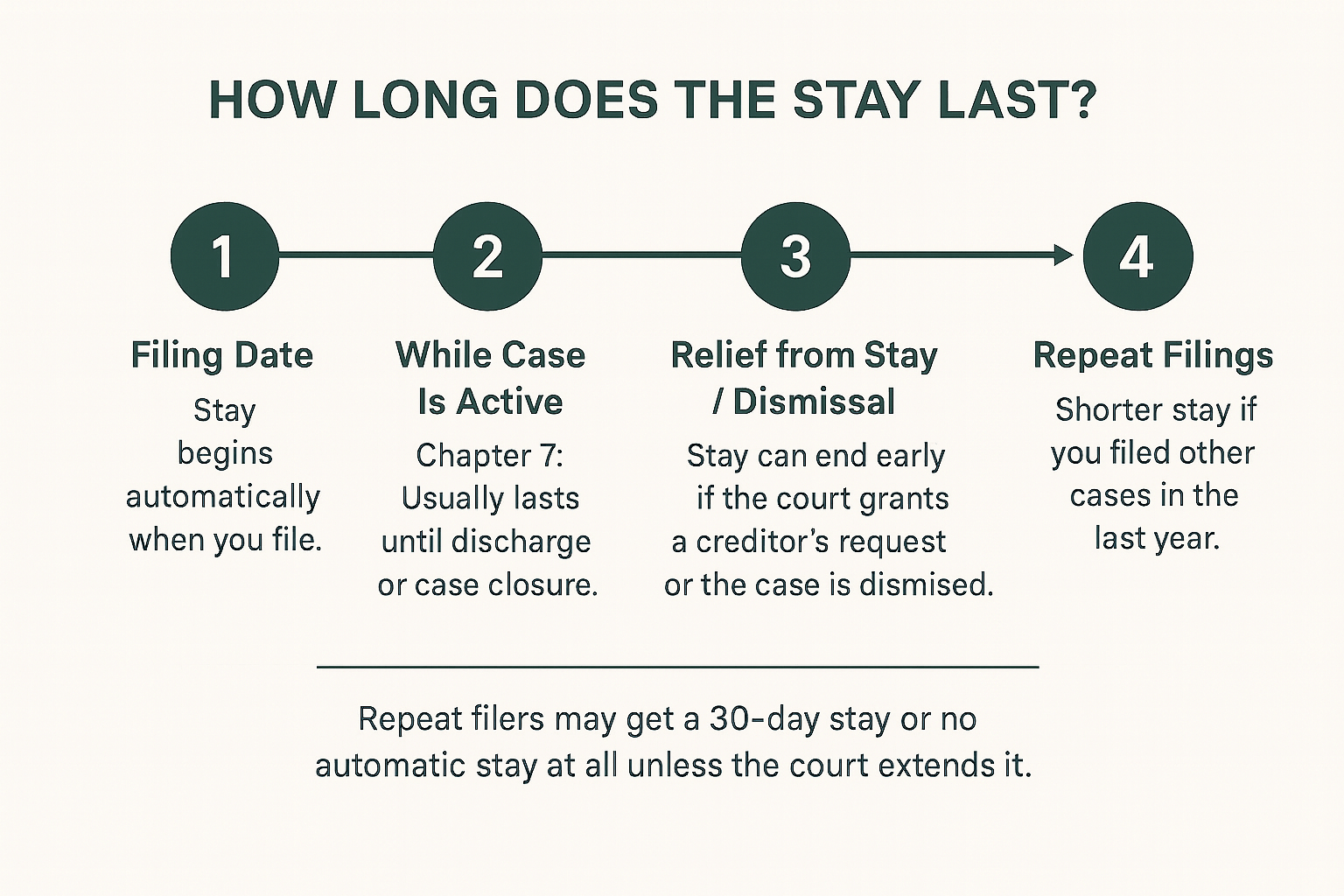

In Chapter 7, the stay remains in effect until case closure and discharge. In Chapter 13, the stay continues throughout the repayment plan unless a creditor petitions for relief based on changed circumstances. Upon dismissal, the stay terminates immediately. Repeat filers face abbreviated stay periods under 11 U.S.C. § 362(c)(3) and (4), requiring statutory findings to extend protection.

Federal law imposes substantial restrictions on repeat filers to prevent system abuse. If a prior bankruptcy case was dismissed within the preceding year, the automatic stay terminates automatically after 30 days unless the debtor files a motion demonstrating that the new filing was made in good faith. For debtors who had two or more cases dismissed within the prior year, no automatic stay takes effect at all upon filing—protection requires an immediate court motion with clear evidence of changed circumstances or legitimate reasons for refiling. Courts scrutinize these motions carefully, evaluating whether the debtor is seeking genuine relief or merely attempting to delay creditors.

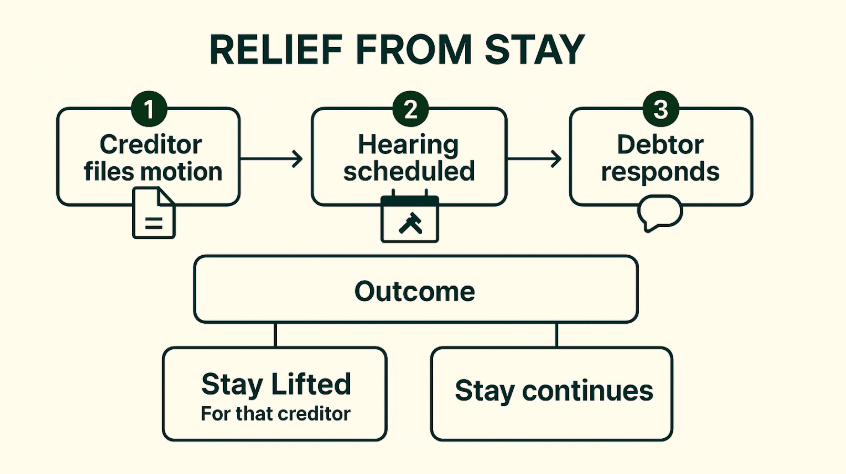

Creditors petition for relief under 11 U.S.C. § 362(d) by demonstrating either lack of equity in collateral or lack of adequate protection. Mortgage lenders seek relief when post-petition arrearages accumulate; auto lenders file when collateral depreciates or insurance lapses. The court conducts an adversarial hearing to determine if the creditor’s interest remains protected. Many disputes resolve through stipulated agreements where the debtor cures defaults or grants additional security.

Chapter 13’s co-debtor stay (11 U.S.C. § 1301) prohibits collection against co-signers of consumer debt while the case is active. This protects spouses or family members bearing contingent liability. The stay terminates upon case dismissal, plan completion, or if the debtor defaults on plan payments. Crucially, this protection does not extend to business debt.

The automatic stay provides substantial immediate relief, but its effectiveness depends on understanding its boundaries. Creditors retain enforcement rights for specific obligations, may petition for relief when collateral requires protection, and repeat filers face significantly abbreviated protection periods. Because the stay activates upon filing—and because strategic timing can determine whether certain creditor actions are halted or proceed—evaluating your specific circumstances with an experienced bankruptcy attorney ensures the stay’s protections align with your financial recovery objectives.